How a Google Data Center Unlocked $1.6 Billion in Arkansas Power Plant Investment

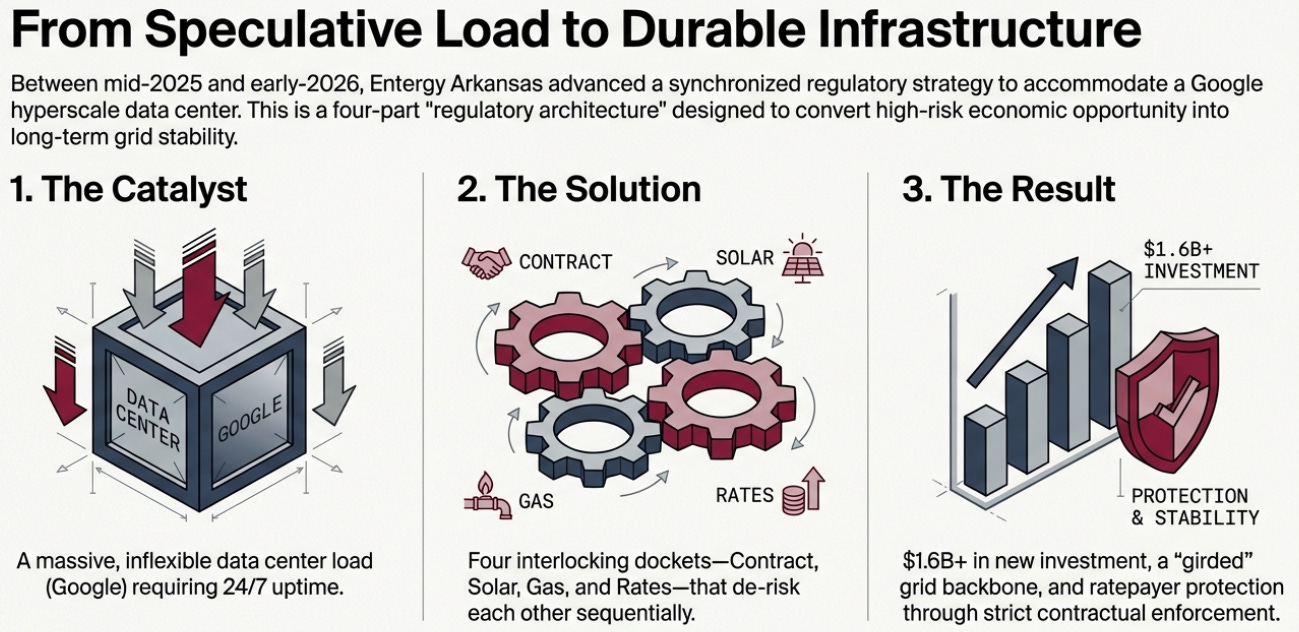

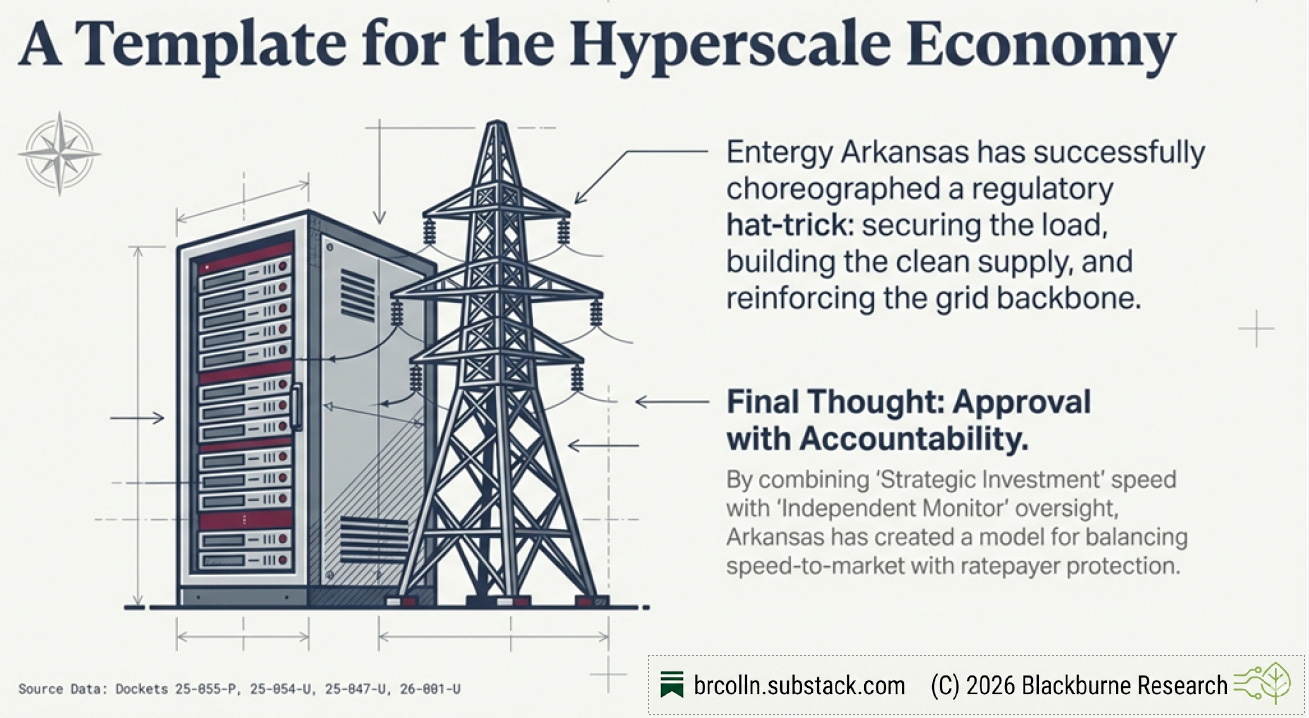

Entergy's playbook to net Google's hyperscale data center— included four dockets, one coordinated strategy, and a blueprint other states will study.

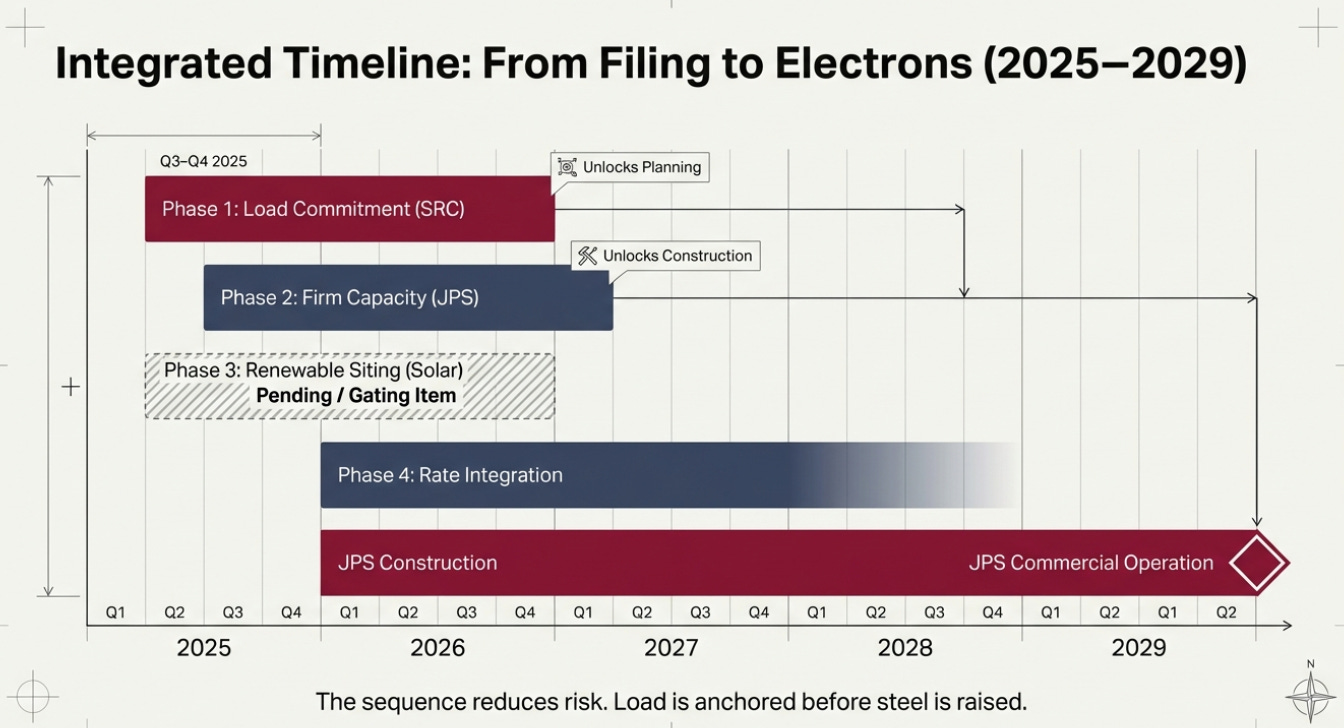

Between mid-2025 and early 2026, Entergy Arkansas advanced four proceedings before the Arkansas Public Service Commission that, taken together, form a blueprint for the hyperscale era.

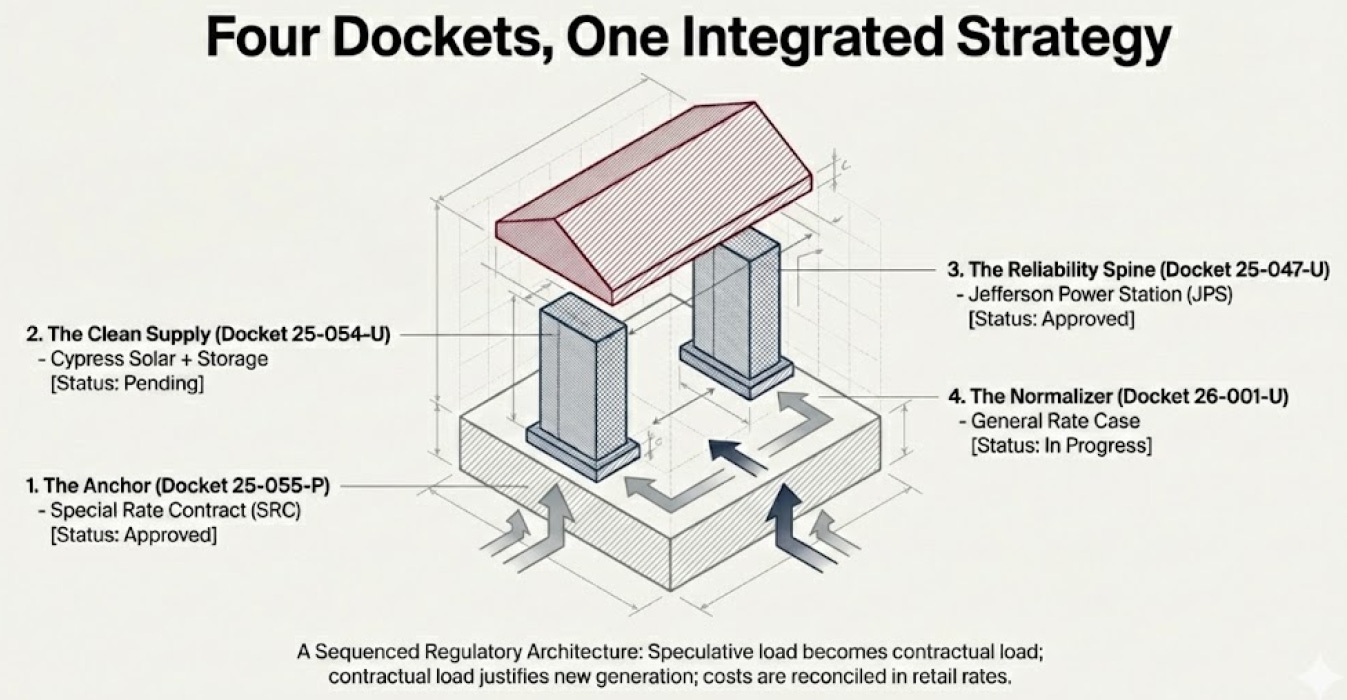

None of the dockets is individually remarkable. A special rate contract. A solar-plus-storage project. A combined-cycle gas plant. A general rate case. Utilities file these constantly.

What makes the Arkansas sequence significant is the coordination. Each docket resolves a different category of risk, and each approval clears the path for the next. By the time the Commission reached the most consequential decision—authorizing a $1.6 billion gas plant—the underlying load was contractually locked and partially offset by customer-aligned renewable investment.

The result is a regulatory architecture that other states, utilities, and large customers will likely study as data center load continues to reshape grid planning nationwide.

The Problem Hyperscale Load Creates

Large data centers present a familiar dilemma for regulators. They promise economic development and load growth, but they introduce risk if that load fails to materialize or shifts unexpectedly. A utility that builds generation for a customer that never arrives—or leaves early—sticks remaining ratepayers with stranded costs.

The Entergy Arkansas filings are best understood as a systematic effort to resolve that uncertainty before committing to major capital.

At a high level, the four dockets answer four questions:

Is the load real and binding? (Docket 25-055-P)

Is there clean energy supply aligned with that load? (Docket 25-054-U)

Is there firm capacity to preserve reliability? (Docket 25-047-U)

How do costs and revenues integrate into rates? (Docket 26-001-U)

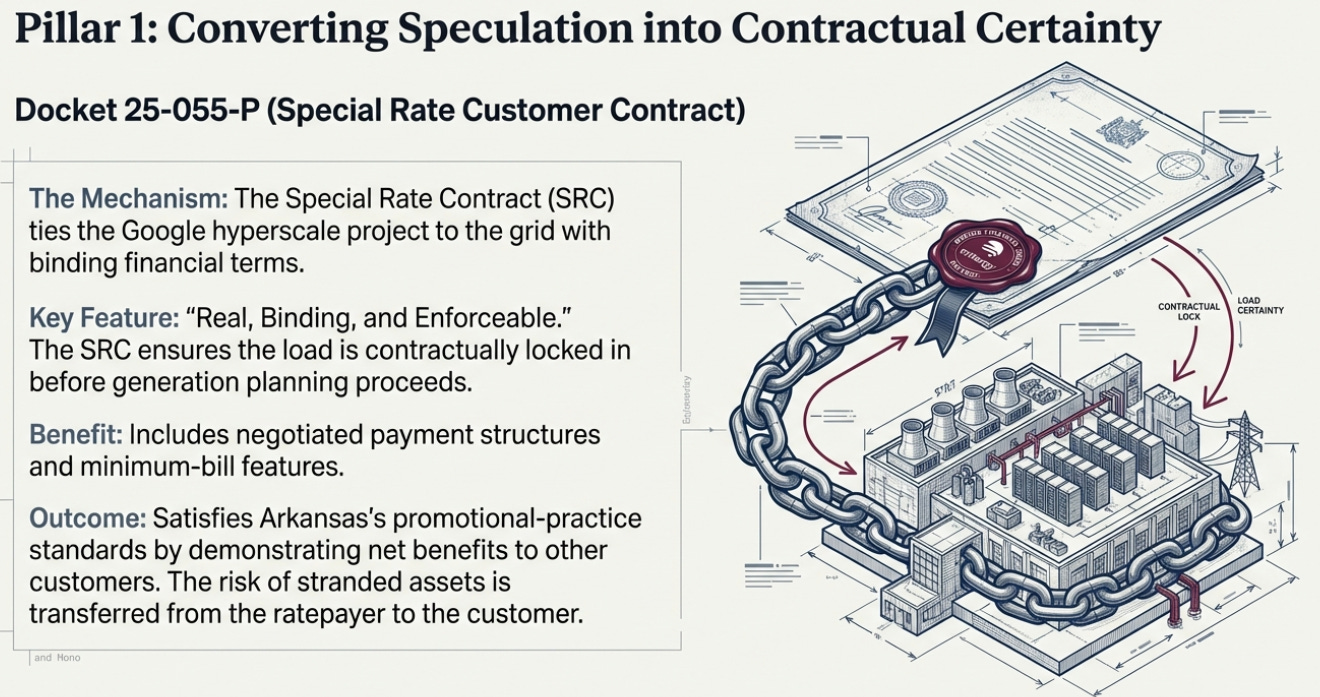

Anchoring Demand: The Special Rate Contract

Docket 25-055-P establishes the commercial foundation. Entergy sought approval for a Special Rate Customer Contract (SRC) tied to the Google data center—a negotiated agreement with minimum-bill features designed to demonstrate net benefits to other customers.

From a planning perspective, the SRC performs a critical function: it converts projected load into contractual load, which regulators can treat as credible for resource planning purposes.

Once approved, Entergy can argue that subsequent generation investments respond to a committed customer rather than speculation. That approval resolves the demand-side risk that typically complicates large capacity cases.

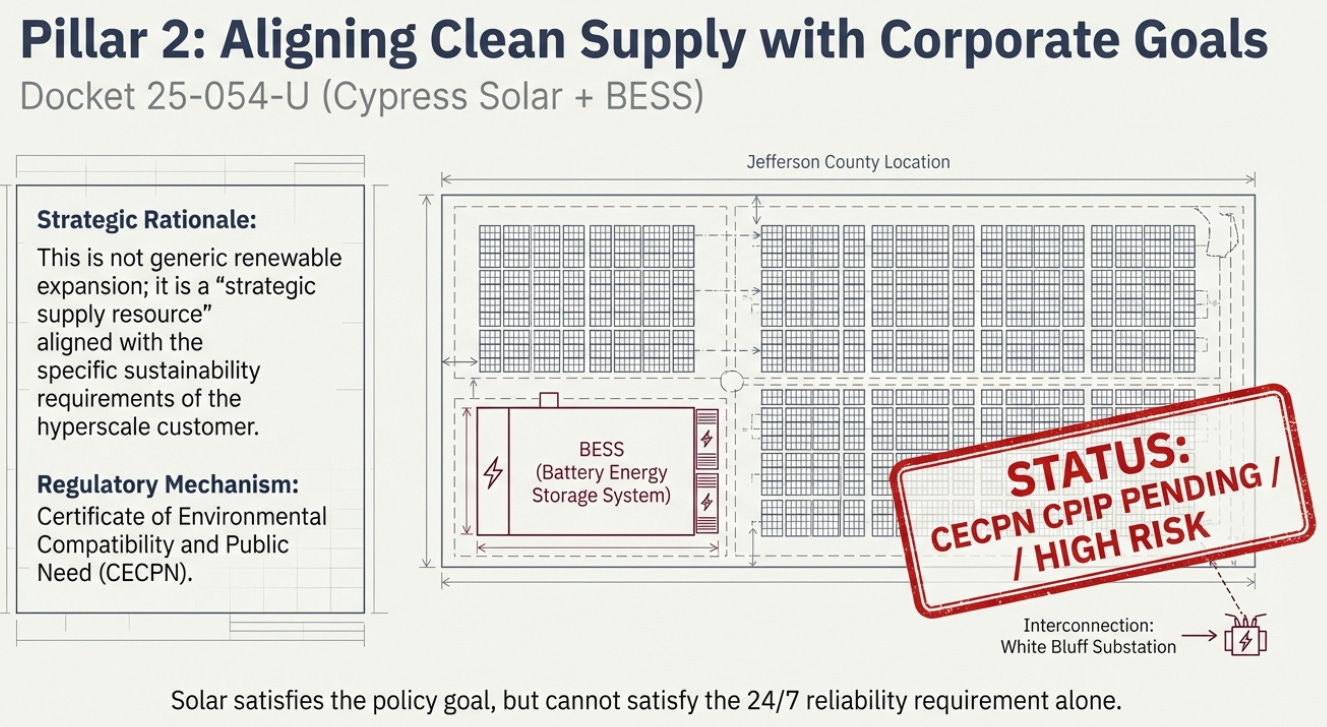

Aligning Renewable Supply: Cypress Solar

With the load contract in place, Entergy advanced Docket 25-054-U, seeking a Certificate of Environmental Compatibility and Public Need (CECPN)—Arkansas’s required approval for major generation projects—for Cypress Solar, a large solar facility paired with battery storage in Jefferson County.

The project is framed not as generic renewable expansion but as strategic supply aligned with an identified customer. This framing helps explain why the project proceeds outside a traditional request for proposals (RFP) process.

Cypress Solar functions as the clean energy component of the portfolio. It supports policy objectives while providing a customer-specific rationale for investment. But solar and storage alone cannot satisfy the reliability expectations of always-on digital infrastructure.

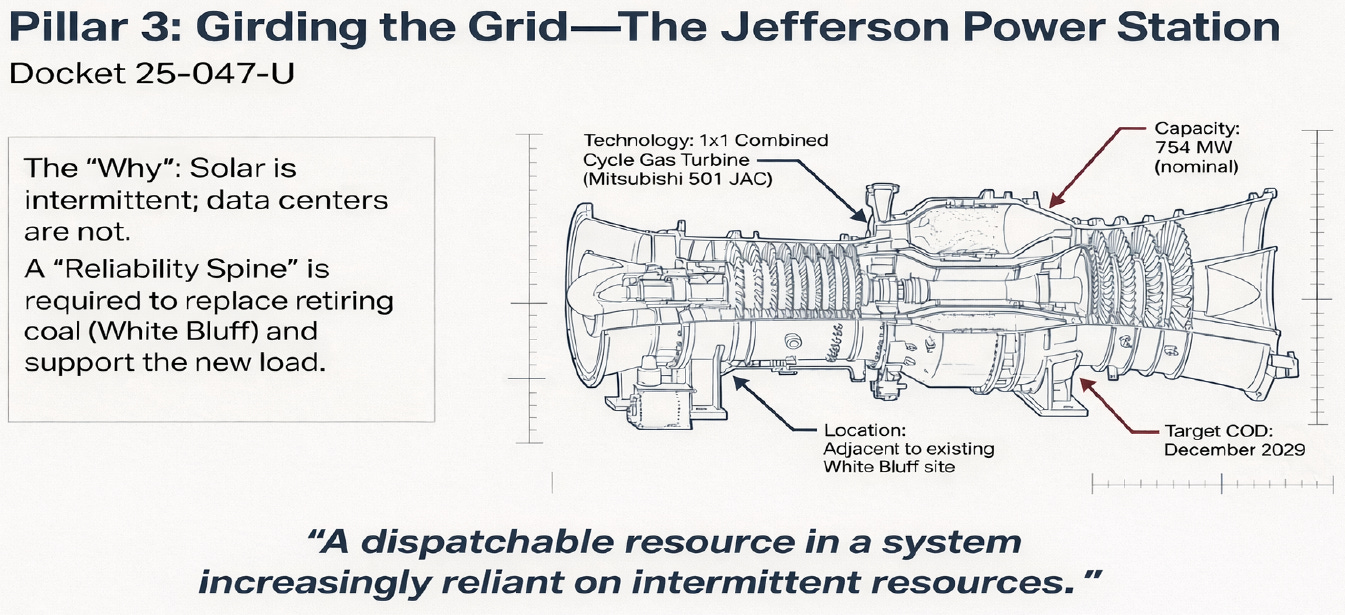

Securing Reliability: Jefferson Power Station

That reliability gap is filled by Docket 25-047-U—the Jefferson Power Station, a large combined-cycle gas facility at the White Bluff site.

The Commission’s review centered on coal retirements, capacity shortfalls, and the need for dispatchable generation in a system increasingly reliant on intermittent resources. The project was evaluated under Arkansas’s strategic investment framework, which allows expedited consideration when reliability or economic development is at stake.

Viewed alongside the other dockets, the Jefferson approval takes on additional significance. Hyperscale data centers are treated in utility planning as inflexible, high-reliability loads with minimal tolerance for interruption. Dispatchable capacity isn’t redundant—it’s foundational.

The combination of Cypress Solar and Jefferson Power Station creates a paired structure: renewable energy aligned with policy goals, firm capacity aligned with reliability obligations.

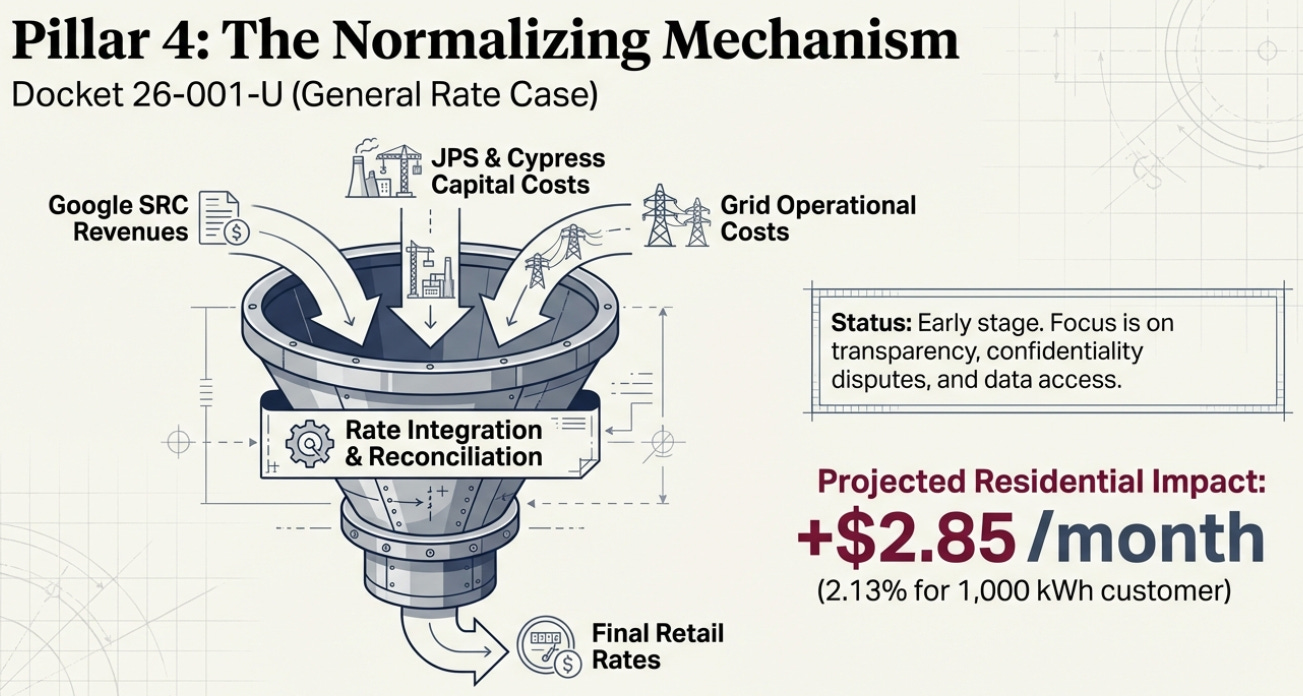

Reconciling Costs: The Rate Case

The final piece is Docket 26-001-U, Entergy’s general rate case. Unlike the other proceedings, this docket doesn’t approve a specific project. It provides the forum where all prior decisions are ultimately reconciled in retail rates.

The case is at an early stage, focused on procedural and transparency issues—particularly the scope of confidentiality over cost and modeling data. But in practical terms, the rate case serves as the normalizing mechanism. It tests whether the coordinated strategy holds together financially once project-specific frameworks give way to comprehensive ratemaking scrutiny.

What to Watch

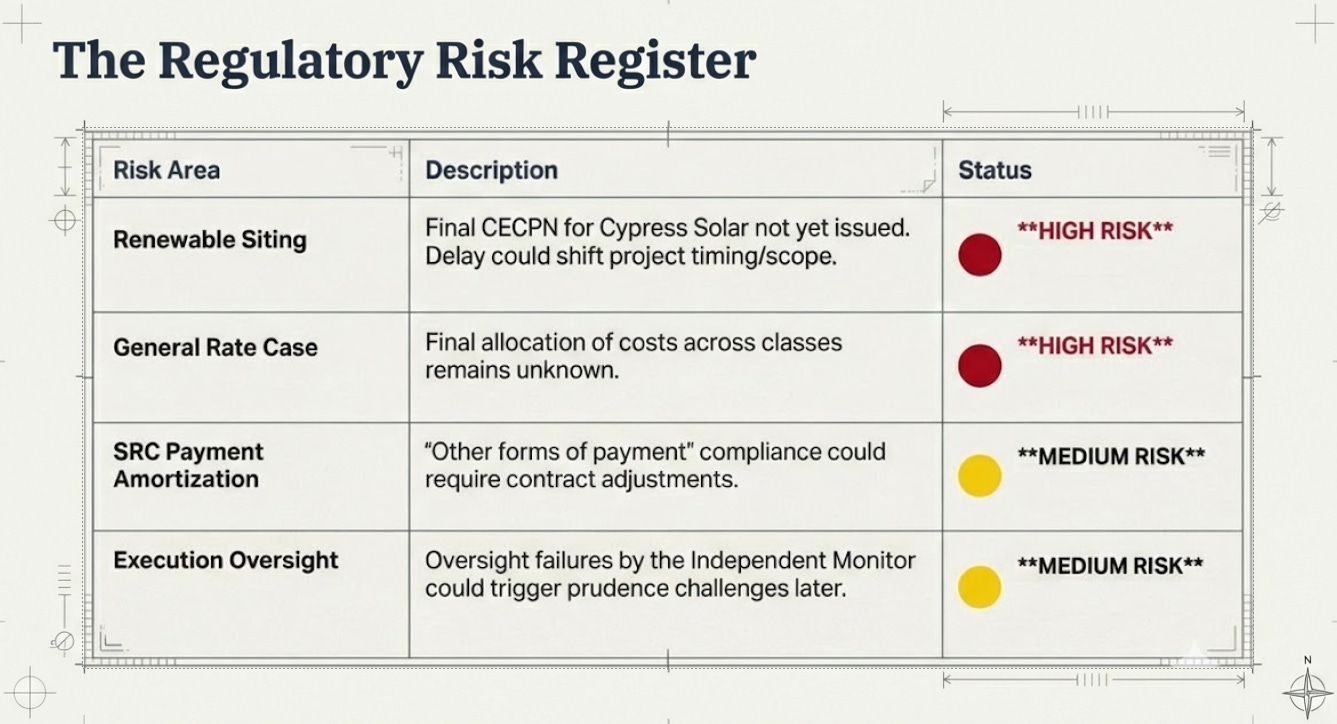

The headline approvals mask several unresolved issues that could affect timing, cost recovery, or precedent:

High stakes:

The Cypress Solar CECPN remains pending—a gating approval for the renewable leg of the portfolio.

The general rate case will ultimately determine how costs are allocated across customer classes.

Medium stakes:

Commission-directed compliance on how SRC payments are amortized could affect near-term customer benefits.

Investment tax credit (ITC) treatment for Cypress Solar has been deferred, creating uncertainty around long-term rate impacts.

Entergy’s rehearing petition on the SRC argues certain findings could require contract renegotiation.

Longer-term:

Acceptance of the strategic investment framework sets precedent for future large-load and generation approvals statewide.

Implications Beyond One Customer

Although the immediate catalyst is a single data center project, the docket cluster demonstrates something broader: how Arkansas’s regulatory framework can be used to attract large-scale digital and industrial load, accelerate both renewable and dispatchable investment, allocate risk among customers, shareholders, and counterparties, and preserve reliability standards during rapid portfolio change.

The Jefferson Power Station approval isn’t an isolated capacity decision. It’s part of a system transition shaped by economic development, decarbonization, and reliability imperatives—all playing out simultaneously.

For utilities and regulators in other states watching data center load reshape their own planning assumptions, the Entergy Arkansas sequence offers a detailed case study in how to sequence commitments so that speculative load becomes bankable infrastructure.